Going, Going…Gone? The Solar Tax Credit May Disappear—Here’s What to Do:

The federal Investment Tax Credit (ITC) for solar energy has been a cornerstone of clean energy incentives in the U.S. Introduced in 2005 and expanded under the Inflation Reduction Act (IRA) in 2022, the ITC currently offers homeowners a 30% tax credit on the cost of installing solar systems. This substantial incentive has spurred widespread adoption of solar energy.

However, recent legislative developments signal a potential shift. In May 2025, the U.S. House of Representatives passed a budget bill, known as the “Big, Beautiful Bill,” which proposes to end the solar tax credit in 2025. If enacted, this legislation could significantly reduce the financial benefits of installing solar systems in the near future.

Homeowners with Solar: Time to Expand?

If you’ve already installed solar panels, you might be considering expanding your system, especially if your energy bills have increased. The ITC currently offers a substantial incentive, but this could change. Expanding your system now allows you to lock in the 30% credit before potential reductions. Additionally, pairing your solar system with battery storage can help you maximize savings by using stored energy during peak hours when electricity rates are highest.

Homeowners Without Solar: Why Wait?

For those without solar, the window to capitalize on the full 30% ITC is closing. Installing solar panels before the end of 2025 ensures you lock in the maximum available incentive, significantly lowering your net costs! Build Brothers is also fully licensed and insured in roofing — if you have any concerns about installing solar on your roof don’t worry, have one of our professionals out to give you a full assessment and to show you how to really maximize your tax benefits.

Solar: Still the Smart Choice, Even Without the Tax Credit

Even if the federal tax credit is reduced or eliminated, solar remains a financially sound investment, especially in San Diego. With SDG&E’s high electricity rates, homeowners can still achieve significant savings by generating their own power, especially when paired with a battery system.

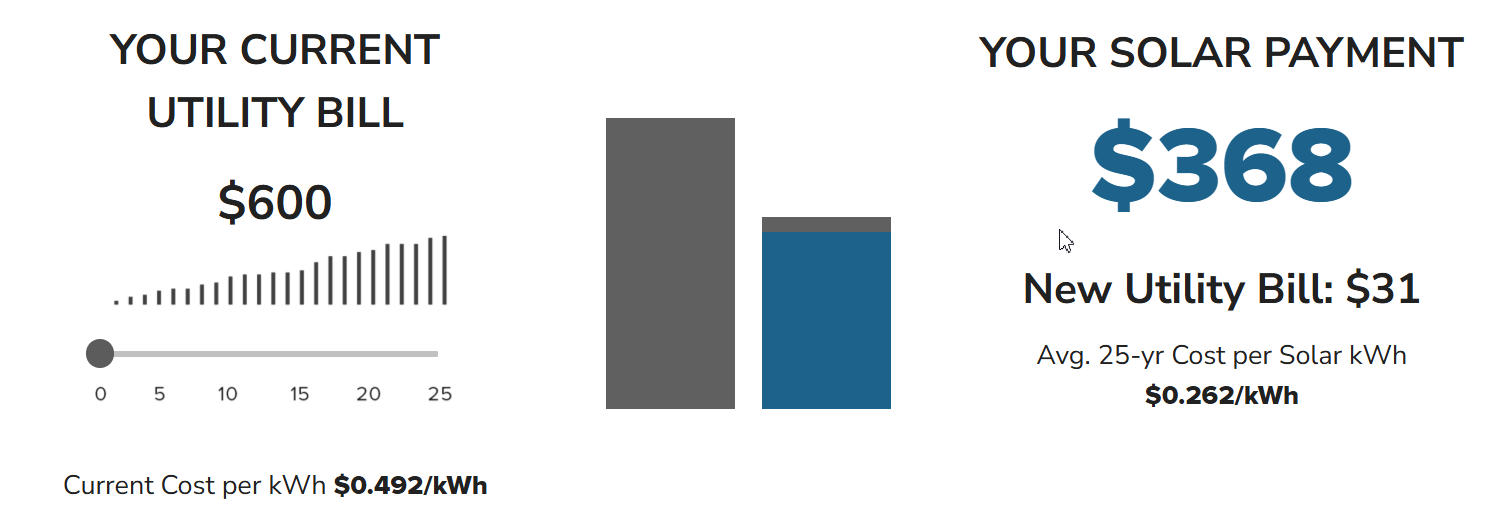

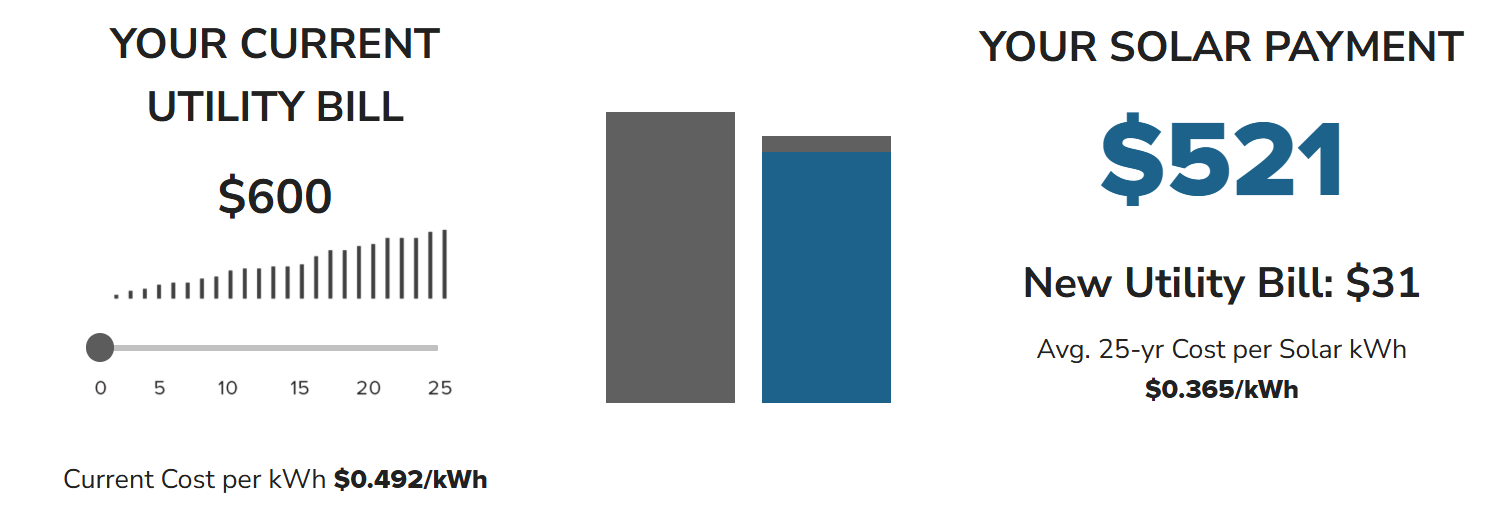

Savings with the Solar Tax Credit

VS.

Savings Without the Solar Tax Credit

Time to Act: The Deadlines You Need To Know

Your system needs to be installed before the end of the year to qualify for the tax credit. That’s just 6 months away now! Build Brothers is expecting unprecedented demand from now until the end of the year and if you don’t act quickly you could miss out on the installation window. Additionally, any time demand spikes equipment shortages can be expected. To secure your spot, get started below:

Great post — I found the examples really helpful. Thanks for sharing!

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I appreciate you sharing this blog post. Thanks Again. Cool.